Original article by Brian Watt on Southern California Public Radio on September 10, 2015

California lawmakers approved a bill Thursday that would give state regulators new power to crack down on employers who engage in wage theft.

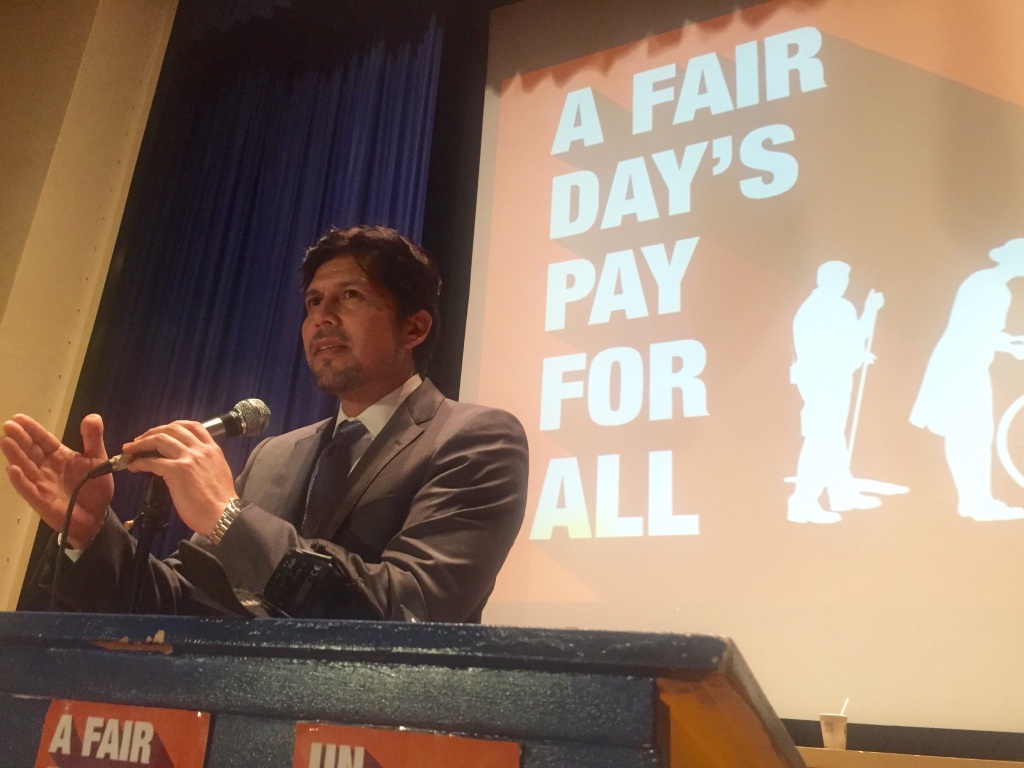

The bill, known as SB 588, was sponsored by state Senator Kevin de León of Los Angeles. It would allow California’s labor commissioner to place a lien on the property of an employer cited for wage theft.

It would also help prevent cited employers from skipping out on paying penalties and back wages by requiring them to post a bond of at least $50,000 to continue doing business. It would also prohibit the company from closing down and re-opening with a different name.

“Stealing the pay of employees who don’t make that much money to begin with is unconscionable. It takes food off their tables and makes it difficult – if not impossible – to provide for their families,” said De León in an emailed statement. “It also violates the fundamental promise of an honest day’s pay for an honest day’s work. With SB 588 we can give the Labor Commissioner the tools necessary to enforce the law for the workers and target the bad actors to level the playing field for honest businesses.”

The bill now heads to the governor’s desk.

Labor groups and advocates of wage theft victims have said California’s existing laws are among the country’s strongest, but they are hard to enforce. Numbers from the state’s Department of Industrial Relations Field Enforcement appear to confirm that.

In fiscal year 2013/2014, the bureau made nearly 400 citations — totaling more than $1.7 million in penalties — related to minimum wage and overtime pay, but it collected only about 17 percent of those penalties. The same year, the bureau found delinquent employers collectively owed nearly $40 million in back wages, but the state was able to collect less than half that amount.

“It is just too easy for employers to get away with it,” said Alexandra Suh, executive director of the Koreatown Immigrant Workers Alliance (KIWA). “It’s not just a problem for workers trying to make ends meet, but for employers who are trying to do the right thing and can’t compete against someone who is willing to pay less than the minimum wage.”

KIWA helped develop the bill and is listed as a “co-source.”

SB 588 would cost the state $2.6 million in the first year and $2.2 million a year after that. The money would come from what’s known as the Labor Enforcement Compliance Fund, which employers already pay into. Exactly how many new staff positions would be created to carry out the labor commissioner’s new enforcement powers is unclear. The Department of Industrial Relations declined comment on pending legislation.

“It’s definitely a start,” said Alexandra Suh about the funding behind the bill. She added that more funding would help the labor commissioner reach more workers who are vulnerable because of language barriers or immigration status.

Spending extra money to enforce wage theft would actually bring more money back to the state’s general fund, because “an employer who isn’t paying a worker minimum wage and not paying them overtime is very likely not paying the income taxes and payroll taxes on that unpaid wage,” Suh said.

If signed by Governor Brown, the bill would take effect January 1, 2016.